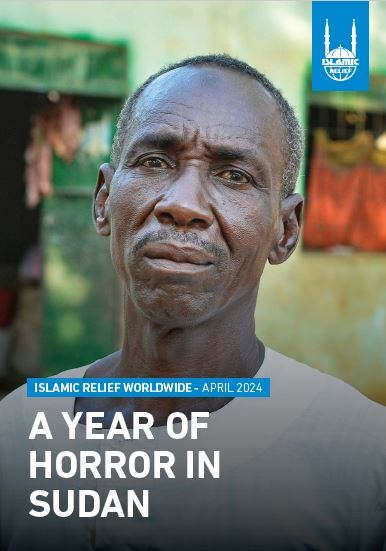

A year of horror in Sudan

The brutal war in Sudan has created one of the world’s biggest humanitarian crises and pushed the country to the brink of famine. One year since the conflict erupted, this report highlights the extreme violence against civilians, the impact of the war on food production and healthcare, and the challenges facing the humanitarian response. With the war still spreading and the humanitarian crisis neglected and underfunded, the report sets out urgent recommendations for the international community and parties to the conflict.

Download/View publication